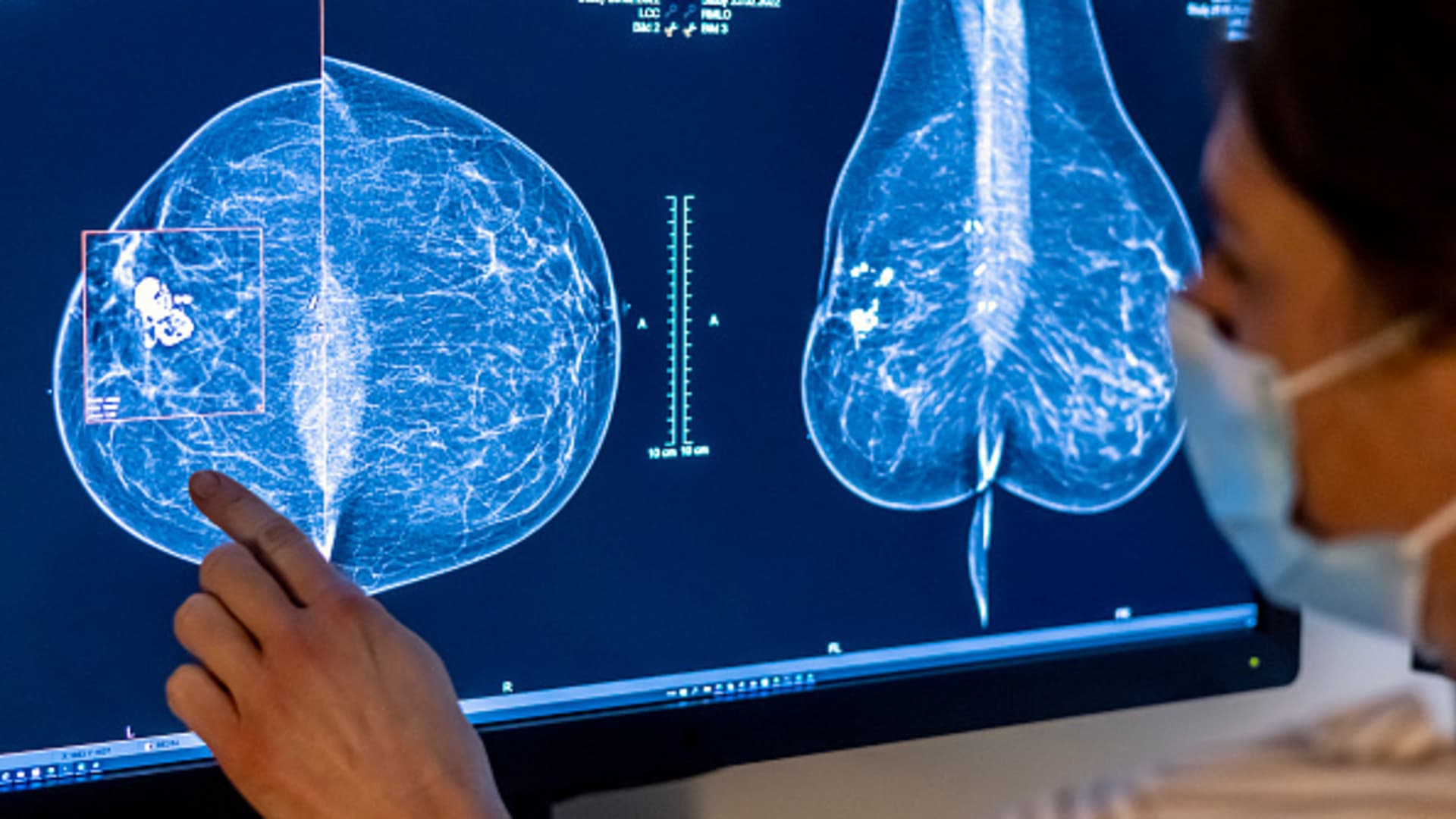

Medical personnel use a mammogram to examine a woman’s breast for breast cancer.

Hannibal Hanschke | dpa | Picture Alliance | Getty Images

SAN FRANCISCO – Established but a promising group of cancer drugs was a hot market in 2023, and more companies could look to treatments to fuel growth in the coming year.

That was the clear takeaway from the JPMorgan Healthcare Conference in San Francisco, the nation’s largest gathering of biotech and pharmaceutical executives, analysts and investors.

During the four-day event, the biotech and pharmaceutical industries showed their enthusiasm for antibody-drug conjugates, or ADCs, which deliver cancer-killing therapies to specifically target and kill cancer cells while minimizing harm to healthy ones. Meanwhile, standard chemotherapy is less selective – it can affect both cancer cells and healthy cells.

Johnson & Johnson announced the acquisition of ADC-developer for $2 billion last week Ambrx Biopharma to bolster its existing pipeline of ADCs, which some researchers believe could herald a “new era” of cancer treatment. Other drug manufacturers such as Pfizer and Merckwhich has closed some of its more than 70 ADC-related deals over the past year, said the drugs will be key growth drivers for its business.

Interest in the drug will continue well into this year, as some analysts expect more ADC trades and advancements currently in development.

The factors driving ADC’s recent rise won’t go away this year, and the fear of missing out among non-entrants will only prompt more companies to enter the space, said Andy Hsieh, an analyst at William Blair & Company. CNBC.

These factors include increased confidence in ADC technology companies and researchers, potentially longer market exclusivity for these drugs, and the rise of attractive ADCs from drugmakers in Asia.

The drugs also have the potential to generate huge profits: ADCs could account for $31 billion of the $375 billion global cancer market by 2028, according to drug market research firm Evaluate. The market for these drugs was estimated to be around $9.7 billion in 2023, another report by research firm MarketsandMarkets said.

“It’s kind of like FOMO, right? Everybody wants to get exposure to (ADC) and basically make it the cornerstone of their whole corporate strategy,” Hsieh told CNBC. “I really don’t see any slowdown and in our view it will pretty much be a continuation of the momentum of 2023.”

Why ADCs became popular

ADCs are not new.

About a dozen have won regulatory approvals around the world, with the first coming in 2000, according to Daina Graybosch, Leerink Partners’ lead research analyst covering immuno-oncology.

She called ADC’s recent rise a “multi-decade innovation cycle” where it took several years for the industry to make some “fundamental transformational innovation that then unlocked more investment and much more potential.”

Improvements in ADC technology appear to have made some newer iterations of the drugs safer and more effective, boosting industry confidence in their potential and encouraging more investment in the space. That confidence has also been fueled by a steady increase in approvals and acquisitions over the past few years, which has convinced some companies that ADCs have a “lower-risk development path,” Hsieh said.

A view of the AstraZeneca facility is seen during Prime Minister Scott Morrison’s visit on August 19, 2020 in Sydney, Australia.

Lisa Maree Williams | Getty Images News | Getty Images

Graybosch highlighted the ADC jointly developed by the company AstraZeneca and Japanese drugmaker Daiichi Sankyo called Enherta, which it described as the first of the “next-generation ADCs,” which had a greater range of treatment compared to older versions of the drugs. For example, Enhertu became the first ADC to show the ability to treat breast cancer patients with both high and low levels of a protein called HER2, which controls how breast cells grow, divide and repair damage.

Over the past few years, drugmakers have fine-tuned key components of ADCs, such as the chemical bond that helps these drugs deliver cancer-causing treatments to cancer cells, according to Hseih William Blair. He said companies are learning how to maximize the effectiveness of these drugs “without getting into too many side effects.”

ADCs still have their drawbacks – for example, cancer tumors can develop resistance to them over time. And not all newer ADCs in development are successful: Last month Sanofi has retired its only experimental ADC after it failed a late-stage trial in lung cancer patients.

Graybosch also noted that companies from Japan and China have proven to be effective ADC developers, quickly “innovating to improve” drugs, bringing ADCs to market that could be better than older versions of drugs.

US and UK-based companies enter into agreements with these international drug makers, such as two licensing agreements GSK signed late last year with China’s Hansoh Pharma for an ADC targeting several types of cancer.

The complexity of ADC technology has likely become another incentive for companies to invest in and develop drugs, Hsieh noted. He said that could reduce the chances of other companies creating biosimilars, allowing drugmakers to keep ADC prices high for longer.

Gilead’s approved breast cancer ADC, Trodelvy, has a US list price of more than $2,000 per vial. But some ADCs on the market have much higher list prices: Biotech company ImmunoGen’s advanced ovarian cancer drug costs more than $6,000 per vial as of 2022.

List prices are before insurance and other discounts.

How some drugmakers are betting on ADCs

Merck now expects $20 billion in new cancer drug sales by the early to mid-2030s, thanks in part to its recent investments in ADCs, executives said during the conference call. That’s double the estimate the company gave at the same conference last year.

The increased forecast signals Merck’s confidence in the future of its cancer drug offerings, even as its blockbuster immunotherapy Keytruda nears losing exclusivity in 2028.. This exposes it to generic competition.

Merck executives highlighted its licensing deal worth up to $5.5 billion with Daiichi Sankyo to co-develop three of the Japanese drugmaker’s experimental ADCs. This year, the company hopes to win approval for one of these ADCs for the treatment of non-small cell lung cancer.

“…We now have a leadership position in antibody-drug conjugates, and we’ve achieved that through what I believe to be very smart deal-making,” said Merck CEO Robert Davis. He added that “all of this actually means growth potential.”

Merck’s newly constructed research facility at 213 E Grand Ave in South San Francisco.

JasonDoiy | iStock Unreleased | Getty Images

Pfizer is hoping the ADCs will help the company turn around after a rocky 2023. Shares fell roughly 40% last year as Pfizer grappled with waning demand for its Covid products and other business missteps.

Pfizer CEO Albert Bourla told reporters that the $34 billion acquisition of ADC-developer Seagen will help restore investor confidence in Pfizer, especially now that the deal is officially closed.

Bourla noted that antibody-drug conjugates have become the hottest area in oncology, adding that Seagen’s expertise in ADCs will give Pfizer a huge advantage in further developing these drugs and establishing itself as a leader in cancer treatment.

Pfizer believes the acquisition of Seagen will generate more than $10 billion in risk-adjusted revenue by 2030. Specifically, Seagen is bringing four approved cancer drugs, including three ADCs, to bolster Pfizer’s own ADC portfolio.