Transition from one crisis to another global economic recovery has no respite andinflation returns to threaten the world.

Attacks by Yemeni militants in the Red Sea effectively closed one of the main ones global trade routes to most container ships that carry all kinds of goods from one part of the globe to another. And they approved the opening of another war front, besides the one in Gaza, which is increasingly dramatic and has unpredictable results.

Question about the Red Sea conflict immediately gained economic importance. A prolonged closure of the region and the Suez Canal could entangle global supply chains and push up the prices of industrial products at a crucial moment in the fight to beat inflation. Indeed, both the US and Europe were slowly heading towards a slowdown in prices, which gave consumers and investors hope for a definitive halt to rate increases.

However,supply-driven inflation, i.e. generated shocks related to the supply of raw materials and goods – the same ones triggered by the pandemic and the energy crisis after the war in Ukraine – threaten to become the protagonist again. The diversion of ships from the usual transit channels around the Red Sea threatens new supply chain blockages. And prices can jump.

Why is inflation threatening the recovery? The answer is in the Red Sea

There is no alarm, but warnings of a complex and dangerous situation in the Red Sea, and experts have begun to quantify the economic damage of a potential prolonged blockade of the passage of merchant ships.

Disruption of shipments in this way could lead to a spikeinflation on some consumer goodscommented the CEO of Tesco (one of the largest food distribution groups in Europe and the world).

“If (container ships) have to go around Africa to get to Europe, it increases transit time, reduces shipping space and increases costs,” Ken Murphy pointed out to Bloomberg. “So it could increase inflation on some items…”.

A series of attacks by Yemen-based Houthi rebels against merchant ships sailing through the Red Sea towards the Suez Canal has already increased dramatically. short-term rates for container shipping between Asia, Europe and the United States. The crisis came not long after the disruption of normal shipping in the pandemic era and once again forced retailers to consider the resilience of their supply chain.

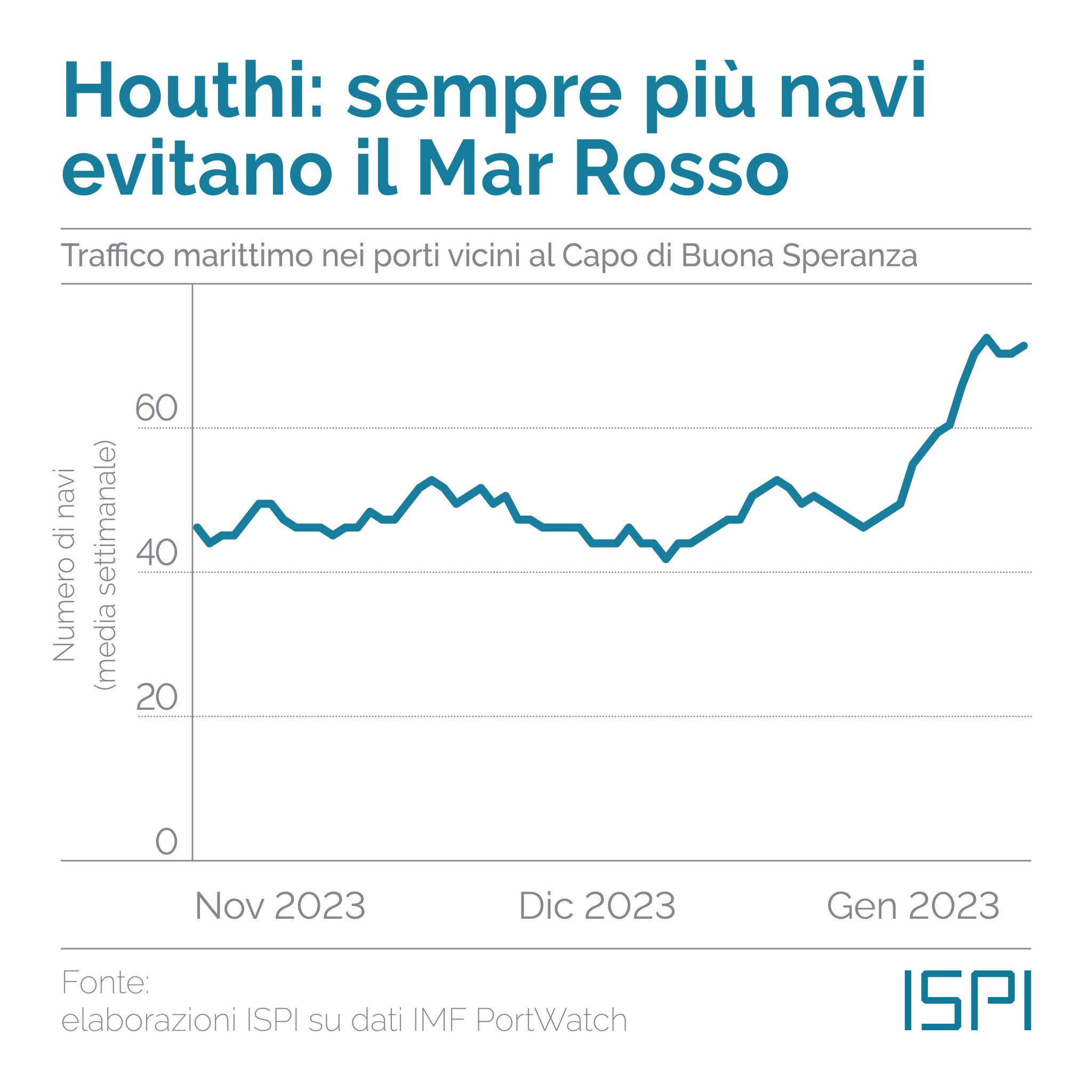

The warning is real and is demonstrated, for example, by this chart created by ISPI experts:

Ships passing near the Cape of Good Hope

Average number of ships per week

Analysts’ comments clearly show what’s going on: “As attacks by Iran-backed Yemeni rebels intensified in mid-December, the number of ships decided circumnavigate Africa increased significantly instead of crossing the Suez Canal. It will also increase costs for the importer of goods who would normally have crossed the Red Sea – including the European ones, of course.’

Among the 10 largest container shippers, 6 of them – namely Maersk, MSC, Hapag-Lloyd, CMA CGM, ZIM and ONE – largely or completely avoid the Red Sea for safety reasons.

If the war between Israel and Hamas escalates into a larger regional conflict, or if the Houthis decide to redirect their attacks on oil tankers and ships carrying key raw materials such as iron ore, grain and timber, implications for the global economy they would be hard.

“In the context of escalating conflicts, energy supplies could also be significantly disrupted, which could lead to sharp increase in energy prices“we read in a World Bank report. “This would have significant effects on the prices of other raw materials”.

A threat toenergy inflation is the biggest risk, according to Capital Economics.

“While current shipping disruptions are unlikely to halt the global downward trend in inflation, a significant escalation of military conflict could raise energy prices, which would be passed on to consumers.”written by Simon MacAdam and Lily Millard.

Oxford Economics also predicts that inflation will continue to fall, but still sees a the risk of price increases. If container shipping costs remain at current levels — nearly double the level at the start of December — it could increase global inflation by about 0.6 percentage point, Ben May, the firm’s director of global macroeconomic research, wrote in a Jan. 4 note.

Finally, it should be taken into account that according to the estimates of Judah Levin, head of research at logistics company Freightos, “all inclusive prices” $5,000-$8,000 per container for major trade routes originating in Asia is 2.5-4 times higher than “normal levels” for this time of year.

However, this value is still 45%-75% lower than theirs “the peak pandemic period” at the end of 2021, Levine noted. At the time, soaring demand for goods from domestic consumers ran into supply bottlenecks, from container shortages to port congestion.

Inflation and uncertainty: what are big companies afraid of?

Chaos in the Red Sea has an impact on shipping schedules and import/export of major companies in general.

“Someone European automakers they diverted their expeditions around the Cape of Good Hope. This led to higher costs and delays of approximately two weeks.said a spokesman for the European Automobile Manufacturers Association.

Retailers love the Swedish furniture company Ikea they warned of delivery delays and possible shortages of some products. So does a British clothing retailer next warned of a likely delay in supply at the start of the year.

Also Crocs listed items destined for Europe will take two weeks longer than usual to arrive.

Simon Roberts, chief executive of J Sainsbury Plc, said his supermarket chain was working closely with the British government to mitigate the impact of the Red Sea unrest.

There is a fear of disrupting the normal flow of goods. There is no word yet of an alarm or an actual earthquake. However, uncertainty about the near future – particularly with regard to developments in the Israel-Gaza war and potential expansion in the Middle East – threatens the global economy and risks push inflation.

“Supply-side shocks are particularly difficult to manage with monetary policy tools”reminded ECB Vice President de Guindos and also specified that inflation is destined for a temporary increase in the Eurozone.